By Pete Peralta

As Chief Digital Officer at BRINK, Pete’s passion and expertise lies at the intersection of innovation, marketing, and technology. He’s helped companies define their digital transformation journeys while working for Hero Digital, Accenture Digital, Publicis.Sapient, and The Irvine Company.

DOWNLOAD REPORT

REPORT AT A GLANCE

10

Real Estate Executives Interviewed

50+

Industry Professionals Surveyed

10

Real Estate Executives Interviewed

50+

Industry Professionals Surveyed

10

Real Estate Executives Interviewed

50+

Industry Professionals Surveyed

OVERVIEW

When it comes to digital transformation and real estate, let’s face it: Compared to many other industries, brick and mortar as a whole is lethargic to change, slow to adopt technology, and requires a high degree of human intervention to complete a typical service or transaction.

The fact that the real estate industry is slow to adopt digital solutions is a direct result of its diverse and wide-ranging nature. While the basic concept of homeownership goes back centuries, today’s real estate products and services are so diverse that calling it one “industry” is practically a misnomer. Real estate spans residential, commercial, industrial, and land development. It is capital-intensive, siloed by region, and marked by long business cycles that reduce the need for transactional speed and volume — thereby reducing the ability and urgency to integrate digital solutions.

Although the promise (or threat) of the digital “buy it now” button still feels like a pipe dream, the real estate industry has made meaningful digital strides over the past decade. And although the post-pandemic work dilemma and latest series of interest rate increases have sent much of the industry into a tailspin, we continue to see an increasing appetite for digital progression in the industry at large. The global PropTech market size was valued at $25,145.1 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% by 2030. This anticipated growth will be driven by the adoption of cutting-edge technologies such as the Internet of Things (IoT), machine learning (ML), artificial intelligence (AI), and virtual reality (VR) across the real estate industry.

While the current economic environment presents financial challenges for many real estate companies, those who prioritize digital innovation with the goal of increasing retention and/or operational efficiency may find competitive advantages over peers who choose to hit pause on their digital programs.

At BRINK Interactive, our team members have experience working with real estate powerhouses like RE/MAX, CBRE, Essex Property Trust, and Berkshire Hathaway Home Services. To gain deeper insight into where and how real estate companies are deploying digital solutions, we interviewed a panel of 10 real estate executives with experience at companies like Newmark, Cushman & Wakefield, and PLACE.com. We also surveyed 50+ industry professionals via an electronic survey distributed via LinkedIn — all in the service of identifying the current state of digital in real estate, and where it’s headed next.

The findings are detailed in this report, which covers:

1. Why real estate continues to be a human-centric business

2. Why the post-pandemic customer experience is more important than ever

3. How smart building capabilities are continuing to expand

4. How PropTech companies are continuing to innovate

5. The emerging technology trends that are next for real estate

6. How to make digital transformation work for your organization

We get it: it can be an exhausting process. At some point, you just need to combine the answers you get with the personal connection you feel and make a decision. But make sure to ask the right questions, first.

1. Why Real Estate Continues To Be a Human-Centric Business

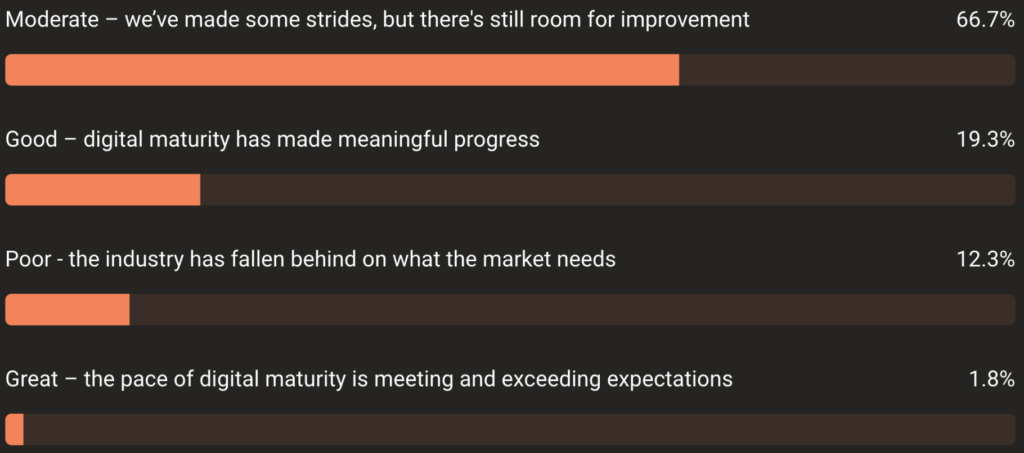

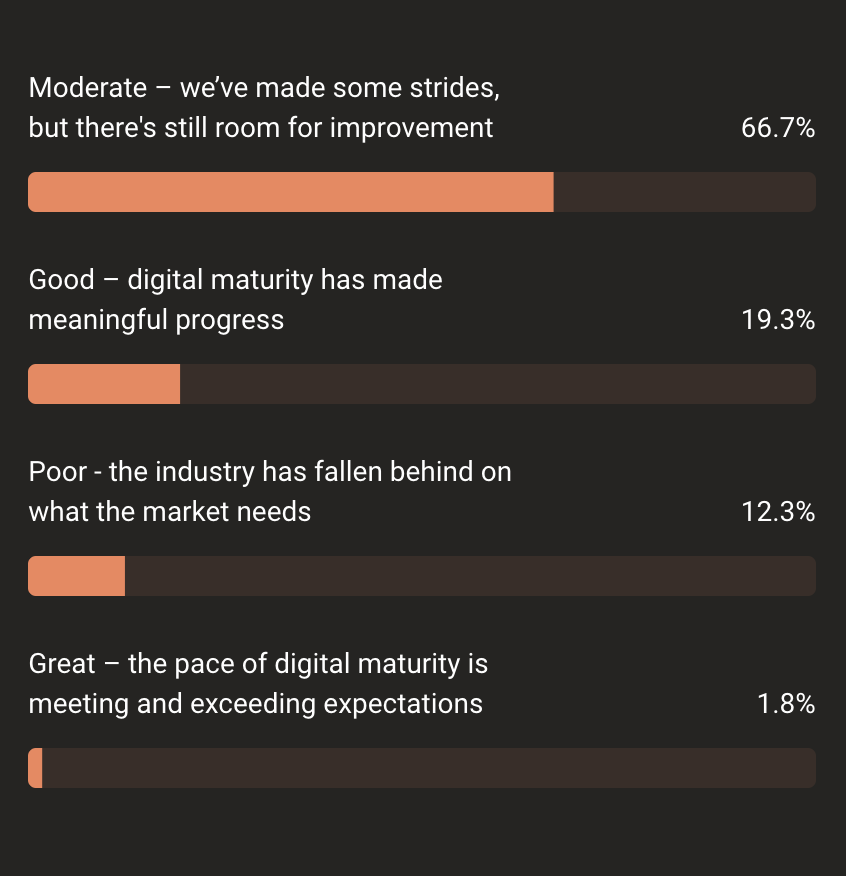

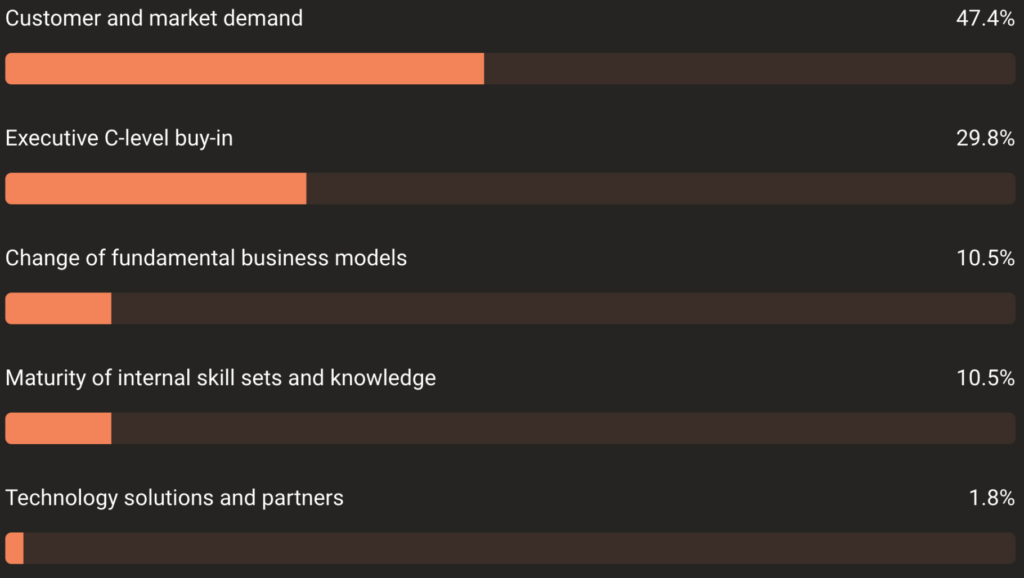

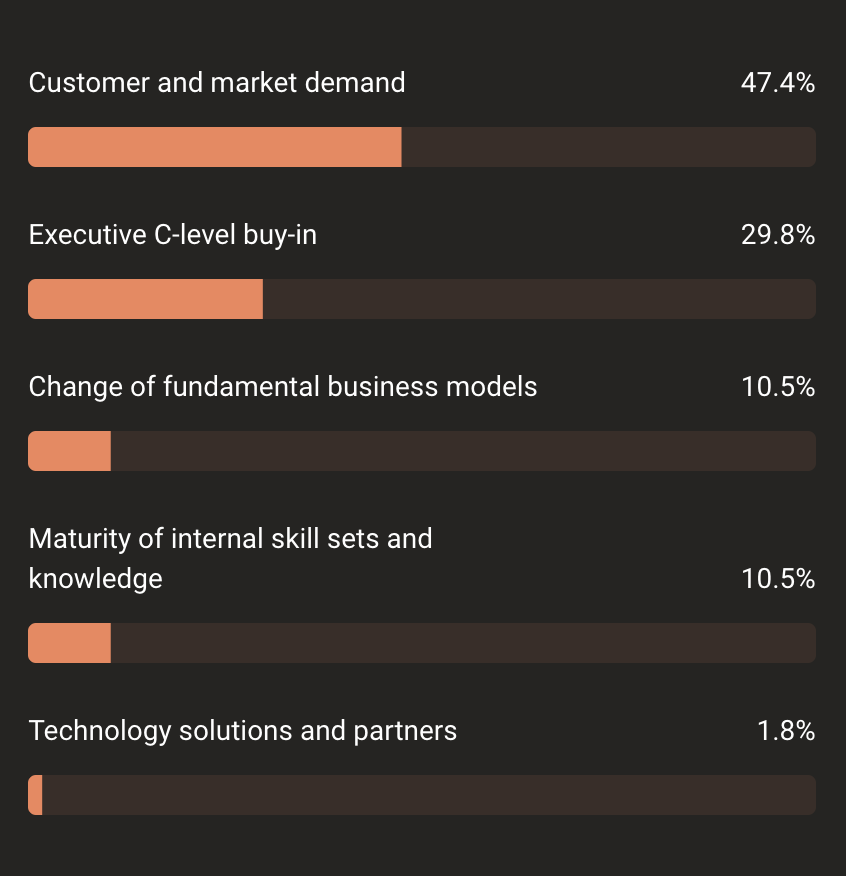

Customers are the beating heart of the real estate industry, and it’s critical that when digital adoption happens, it happens based on customer needs and demands. Of the professionals we surveyed, nearly half of respondents cited customer and market demand as the driving force behind digital innovation.

As customers want and expect different things in a post-pandemic world, digital progression will be essential to keep up. Successful transformation will require a successful understanding of who your customers are based on successful data collection and analysis. Ultimately, a commitment to customer experience will mean transforming entrenched business models using the power of digital in new and meaningful ways.

Trailing close behind customer and market demand is the role of executive level buy-in to the digital agenda. Most great leaders prioritize customer demand, but not all real estate companies are equally willing to act on those forces in ways that change their fundamental business models. Case in point: traditional brokerage firms.

“Legacy large firms are heavily weighted on the brokerage side of the business and the capital market side of the business,” says Ari Baetiong, the former managing director at Newmark. “When the culture is such that it’s driven so much by the traditional power brokers, the business model of many real estate firms hasn’t done a good enough job keeping up with the pace of change over the past few decades. Priorities and drivers remain the same, but end user space requirements extend far beyond real estate matters.”

It takes a lot of convincing to infuse major digital changes into an old-school realm — especially when the current method has been so successful. There is no doubt that this has prevented digital transformation from taking root in many companies, particularly when they are brokerage-led.

In residential real estate, implementing customer-centric solutions is also difficult, but for a very different reason: regional differences that result in fragmentation.

says Grady Ligon, Chief Information Officer at RE/MAX. “There are enough business models out there and you can’t find this overall ‘thing’ that can standardized and say: this works for everybody.”

While digital progression holds immense untapped value for the real estate industry, it remains human-centric in another key area: the valued role of traditional agents. Although there are some digital-first technologies that largely remove the role of human agents, sellers are still more comfortable having an agent represent the sale of their asset.

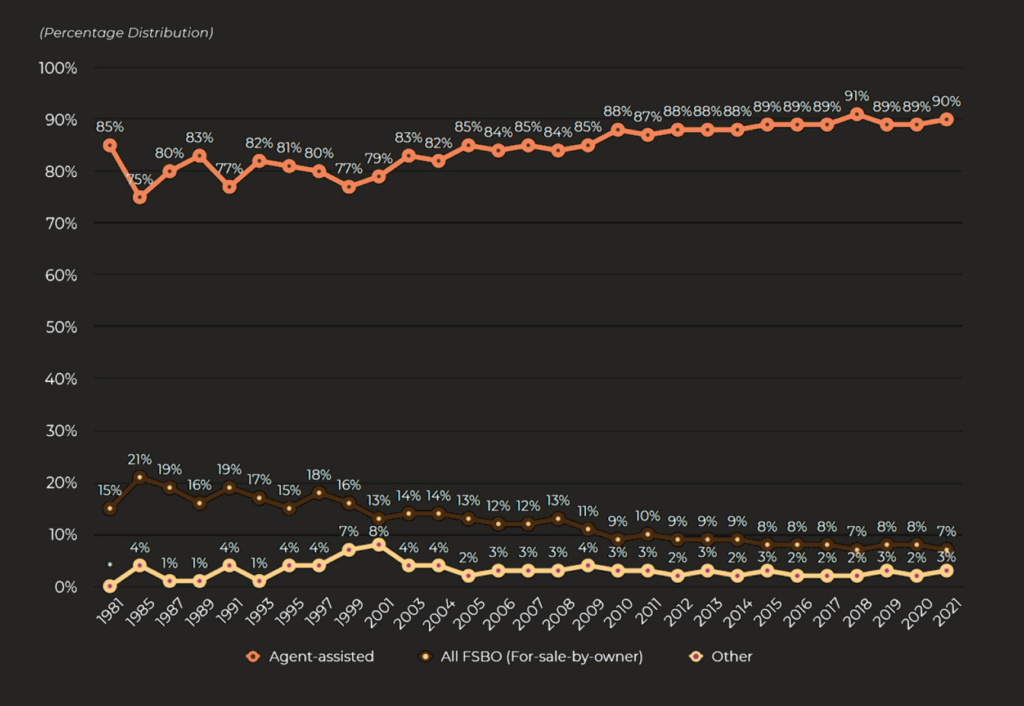

According to the 2022 report by the National Association of REALTORS® Research Group, 90% of homeowners used a real estate agent to sell their homes in the previous year. In fact, the FSBO rate (for sale by owner) has been steadily dropping since the organization first began keeping track in 1981, and has stayed relatively flat over the last several years. It makes sense: buying or selling a home is one of the largest transactions the average person will make in their lifetime — making trusted human interaction a priority.

Graph adapted from eXp Realty

Real estate transactions require confidence on the part of customers, and for the foreseeable future that will mean not just using digital in isolation, but a new symbiosis of digital and humans. Digital transformation will undoubtedly alter the role of real estate professionals, just as it will change the daily workflow of professionals across other industries. The key is finding ways to use technology as a positive enabling force.

So what is the role of digital in a human-centric industry? It comes down to:

- Making service professionals more efficient

- Accomplishing more with less

- Shortening time-to-market

- Empowering customers/tenants with information

The real estate professionals we interviewed emphasized that the role of digital centers on convenience: Finding ways to augment critical human relationships with digital conveniences such as rent payment services, maintenance requests, and property management are key.

2. Why the Post-Pandemic Customer Experience Is More Important Than Ever

Changing human behavior is perhaps most dramatic when it comes to the impact of the pandemic. The repercussions for real estate and the resulting appetite for digital adoption cannot be underestimated, and the ripple effects of COVID are still being felt throughout the industry.

Commercial Impacts

On the commercial office side, without a doubt the most critical theme that arose in our reporting was the need to drive the workforce back to the office. CEOs and real estate executives are hoping technology can make a significant difference in improving the tenant/occupant experience. But complexity is growing around how to service and improve the working environment in this post-pandemic world. Workspaces are no longer dedicated to a single individual, and office managers are struggling to rethink models that are tailored to a hybrid workforce. The winning model will be workspaces that are more flexible, collaborative, and enticing to drive people back to the office.

In order to better understand how technology is impacting the work environment, many executives in our study are leaning into data and analytics. “Connected data is the most critical key for some of these big brands to really understand the relationships they have with their customers. The biggest hill to climb is to break down these data silos and to really understand what relationships are and what outcomes are,” says Eric Wagner, a digital marketing consultant and the former Head of Global Digital Marketing at Cushman & Wakefield.

This focus is echoed by Aaron Schrems, Global Head of Product & User Experience at Cushman & Wakefield. “When I hear our leaders talk, they’re talking about how do we connect better to serve our customers?” he says. “The North Star and the orientation is around the customers and the value that we have internally that we need to bring together to the market.”

Both landlords and corporate tenants have a critical role to play in getting employees back into offices. Employers must deftly navigate the pressures of hybrid and remote work policies, while landlords must strive to create an improved tenant/customer experience.

Digital solutions can have an immediate impact on improving the tenant/customer experience if we can find a way to connect the dedicated spaces of tenants with smart technologies within buildings and facilities, along with the community and surrounding shared amenities. These inherent domains require partnership and technology interoperability between landlords, asset managers, and employers alike.

Multi-Family Impacts

While the pandemic has significantly disrupted the commercial office side of the industry, it has also served as a digital transformation catalyst for multi-family.

New mobile digital experiences that elevate service levels have quickly become standard in the muti-family space, including:

- Smart home technology

- Digital rent payment

- Online maintenance requests

- Package drop-offs and storage

- Concierge services

One executive we interviewed described the dramatic COVID-driven shift that occurred, saying: “It was problematic for new prospects to physically come into our sales offices and tour our apartment communities with a sales representative. It was both uncomfortable, and many times impossible, for prospects to learn about our amenities during an onsite tour.”

This presented an opportunity to lean on digital and technology to fill the void. In a matter of months, this company pivoted to their mobile channel and allowed prospects to self-tour the physical properties with their mobile app as a guide. Not only did this fill a pressing need, but the number of tours actually increased overall, and the company received overwhelming positive feedback. It turns out that prospects preferred touring apartment communities on their own, without the pressure and need to have a company rep looking over their shoulders. In addition, the company was able to consolidate multiple sales offices into a center of excellence. This led to efficiency, better quality service, and significant cost savings.

Retail Impacts

On the retail side of the equation, retailers quickly introduced new curbside pickup practices during the pandemic and are now leveraging Web 3.0 in innovative ways to drive shoppers to their centers.

It’s critical that today’s retail brands continue to find synergy between their e-commerce and traditional brick and mortar channels. Landlords can help bridge the gap between digital and physical channels by introducing technology that helps shoppers view in-store inventories, combine items from multiple retail stores into one curbside pickup, host virtual events, and built customer loyalty.

At BRINK, one of our real estate clients is exploring ways to extend physical retail centers into the digital space. They are searching for avenues to enhance the in-venue shopping experience by rethinking the traditional directory as a more engaging experience leveraging advanced mapping and AR technology. Our work will provide the client with a customer experience foundation for AR activities, including the ability to leverage features such as AR promotions, eCommerce, and loyalty programs that offer opportunities for increased customer engagement during retail visits.

3. How Smart Building Capabilities Are Continuing To Expand

One of the fastest growing areas of real estate continues to be the global smart building market. According to Grand View Research, the market size is expected to reach $570B by 2023 and expand at a CAGR of around 25%.

In our study, BRINK found that corporate real estate departments and owner/operators are investing in three main smart building categories:

1. Access control systems

2. Energy management

3. Building infrastructure management

But while smart building technologies are advancing, retrofitting older commercial properties still has a long way to go.

“If you’re building a physical building and you are prepared from the get-go to be digital, then you can do so many exciting things like installing sensors and all of those IoT super fun things right from the get-go. It’s a no-brainer for new construction, and you can do it all at the same time. But for older, more dated assets, we don’t have that luxury. Often times the effort levels to upgrade or retrofit an existing property may be too great. So asset managers have to really justify the value in the upgrade.” says Kris Drey, Director of Digital at a rental housing industry leader.

Another challenge real estate companies face with smart building technologies is scale: the ability to extend solutions across real estate portfolios and interoperability between discrete solutions.

says Baetiong. “Applying AI/ML as a next layer on smart buildings is going to decrease bad decision-making, increase efficiencies, increase utilization, and allow owner/occupiers to make quicker decisions on reorganizing space.”

The key to furthering smart building will lie in connected data. In order to increase service levels for customers, real estate companies will have to bring disparate systems and data together by either investing in a middle layer technology that allows best-of-breed solutions to be seamlessly plugged in or pulled out as needed, or by relying on current smart building technology standards and protocols to mature. The former can require high investment levels. The latter will take time for the industry to evolve.

4. How PropTech Companies Are Continuing To Innovate

While smart building technology and customer experience represent the most visible part of digital transformation, PropTech is perhaps the most powerful. The real estate industry now boasts some of the best-of-breed and highest profile SaaS technologies on the market.

Today’s software companies are expanding beyond fundamental operational tasks — they are now focusing on the holistic customer journey. The result? PropTech is identifying opportunities and deploying solutions for problems that the market has not yet addressed.

Innovative SaaS Solutions

Real estate software providers such as MRI Software and PLACE are leading the way in SaaS and are aggressively incorporating emerging technology into their products. At MRI Software, Industry Principal Brian Zrimsek described the company’s AI-first mentality and the exciting ways they are leveraging AI in their products.

“We can take your commercial leases and run them through the AI tool to pull out all of the key clauses so you can then query them,” he says. “We can then put it into MRI or other systems. This lets you move from that piece of paper, that’s always a one-off in the commercial space, to a searchable and reportable data set.”

The application has downstream ‘Intelligence’ benefits: for example, if a customer purchases their own renter’s insurance policy, the AI can inspect the declarations page, pull out the coverage date and coverage limits, and pull the data into a database to help landlords and asset managers mitigate risk by ensuring all residents in the building have appropriate coverage.

Chris Stuart, residential real estate veteran and President at PLACE says, “As we continue to wade through the various models and opportunities available to the consumer, I believe the role of the professional real estate salesperson is elevated, not diluted or disintermediated.”

Stuart sees opportunity with new professionals and brokerage firms coming into the industry. “The current real estate environment is marked by historically low rates and low inventory, with no end in sight. This dynamic leads to a tectonic shift in what real estate relationships look like — I think that the industry has largely been focused on transforming the pre-transaction part of the real estate life cycle,” Stuart says.

He envisions an opportunity to extend the relationship to the post-transaction phase, transforming the role of agents to the role of full-cycle trusted advisor, similar to the way the life insurance industry shifted decades ago. “Our business model is somewhat unique, and with the absence of loyalty to many of the solution partners out there, I believe we’re positioned differently to solve for that.”

Navigating “Buy Versus Build”

The continued potential for PropTech is undeniable. Yet companies must continue to carefully consider the technology that is being deployed, how much change it requires, and the value it brings. Many executives we spoke with addressed the buy versus build dilemma. Making the right decision hinges on asking two key questions:

1. How sustainable is the technology?

2. How do you maintain the technology?

Grady Ligon recounted how about five years ago, during the top of the real estate cycle, RE/MAX decided to acquire a technology company that handled websites, CRM, and lead routing.

“What we realized is being a technology company and being a real estate franchisor are pretty incompatible. One of them is going to get primacy in your focus … the truth of the matter is it’s not necessarily the project of building things out and the dollars and time that entails that kills you. What kills you is the fact that you have just changed yourself from a services company to a product company,” he says.

Buying technology comes with its own considerations. If a given technology does become a critical part of your value chain, you need to determine how you will embed the solution within your company in a way that is sustainable long-term and reduces risk. For example, is the primary vendor you rely on going to be around a decade from now? Will managing that vendor be sustainable? If that vendor is no longer a good fit, will you be able to easily unplug and plug in with something else?

Both paths come with incentives and drawbacks that real estate companies must navigate with care. At BRINK, we find it imperative to consider technology that will support your future company vision, not its existing state. Often, technology platforms offer robust capabilities for accomplishing different levels of transformation. But you’ll also need to invest in the people, processes, and strategy needed to support the technology you build or buy so that it can reach its full potential.

5. The Emerging Technology Trends That Are Next for Real Estate

The real estate industry may never be early adopters of the latest and greatest emerging technology. More than likely, real estate executives will take cues from industries like hospitality and commerce and figure out how meaningful applications in those adjacent industries may be applied.

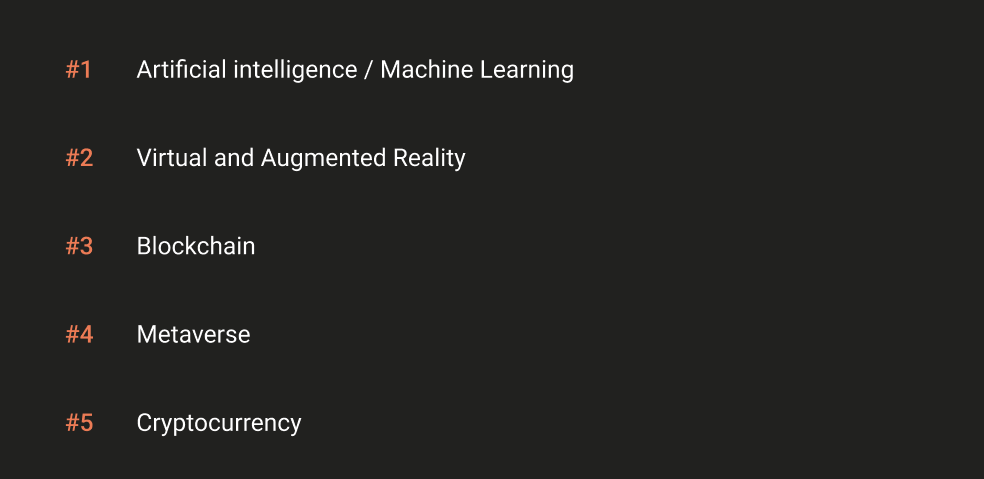

Yet the digital momentum in real estate that was triggered by the pandemic has led to sustained interest and investment across the digital spectrum. Our survey found that most real estate professionals were most excited about the impact of AI/ML, with AR/VR a close second. Meanwhile blockchain has a clear potential role, but there are massive logistics to figure out first.

The results of our survey question asking participants to rank the importance of emerging technology mirror findings in the PwC 2023 Emerging Trends in Real Estate report, which also cited the results of a survey where participants were asked to rank their appetite for industry disruptors that included AI/ML, augmented/virtual reality, blockchain, and more.

Artificial Intelligence and Machine Learning

Of all the emerging tech we polled our experts on, AI is the area that already seems to be the star of the show. As discussed previously, AI as a success lever has already been heavily embraced, particularly by the PropTech software companies that serve the real estate industry.

In addition to facilitating successful commercial leases and applying contract intelligence, AI can be used to understand footfall — helping mall operators, retailers, office complexes, and more gain a better understanding of traffic volumes and demographics. The system can leverage existing cameras with scope ranging from one camera on the door to several across a facility.

“It’s a great use of AI. It’s non-invasive. No one has to sign up or opt in, they just have to be there. We know that they drove by, or walked by, or entered, and we just count the number of people without identifying them individually,” Zrimsek says.

As real estate professionals see more value in uncovering human living habits and devising the best use of space, such applications of AI can prove infinitely valuable.

AI’s impact on agents is also inevitable.

“Put yourself 36 months in the future. If I can really get some sort of digital assistant to do a lot of the legwork that an agent can do, that changes the role of an agent. It doesn’t remove the need for them, it just changes the work that they have to do themselves, and it makes the contribution that the AI can’t provide all that much more valuable,” says Ligon.

He believes that the trajectory of digital is clear: AI is not going to replace agents, but agents who are not open to adopting and using technology will be replaced.

When you combine AI with machine learning, you can truly get the best outcomes across the board in terms of surface diagnostic and prescriptive maintenance recommendations for properties of all sizes — and particularly large spaces such as office and apartment buildings that can be better monetized.

“AI gets the headline, but machine learning, if we can split those hairs, is where the real estate industry might have some more opportunity. Ultimately the outcomes are business outcomes that speak the language of the client: save money, change your CapEx trajectory, etc.,” explained one of our participants. “The amount of money clients spend on their facilities and properties will undergo a heavy look, if not a little bit of transformation, on how do we be more shrewd about that and use the transactional data that’s been compiled to date and make better investment decisions.”

When data stops being noise and starts adding value, you can accomplish everything from better maintenance to better layout to a better customer experience.

Virtual and Augmented Reality

AR and VR is one area that continues to have immediate value and upside within the industry by reducing operational costs, decreasing time-to-market, and increasing internal collaboration.

Applications of the technology can also be used to showcase and service existing properties, as well as visualize properties that don’t yet exist.

- Architectural visualizations – Virtual architectural visualizations serve to provide a realistic representation of both the exterior and interior of properties yet to be built, allowing developers, investors, and designers to visualize and collaborate on future projects in real-time.

- Property tours – Virtual showing allow potential buyers to experience the property remotely, which is especially valuable for buyers or business representatives who may not be able to physically visit the asset. Many homebuilders and commercial developers have been using this technology to sell or lease space before development of the asset has been fully completed.

- Property maintenance – Virtual reality tools such as VR headsets assist property managers and maintenance crews to identify and address maintenance issues such as plumbing or electrical systems in 3D, making it easier to identify and diagnose problems. In addition, these technologies can be used to create maintenance checklists or serve as tutorials for new employees.

The investment and effort levels to design and deploy these experiences are often minimal, and costs can be further offset by leveraging existing 3D asset models. And unlike other industries that have struggled with practical use cases, the application of AR and VR technologies already have proven value in the real estate industry. Almost all of the experts we interviewed in this study were exploring or had already deployed successful AR/VR experiences.

Blockchain

While cryptocurrency hasn’t taken off as many expected, many real estate leaders remain bullish on the potential of blockchain.

“As a foundational technology, it makes a lot of sense,” says Ligon. “The idea of blockchain is the whole idea of this distributed ledger. There’s tremendous potential there in the industry overall. The obvious implication is title.”

If you can use blockchain to get chain of custody on your title, it essentially eliminates the need for traditional title insurance. That’s because blockchain is designed to be an unimpeachable ledger that proves without a doubt whether someone possesses clean title for a property or not.

With blockchain, the lengthy leasing process has the ability to be streamlined into mere minutes. When you transition the legal steps that must be taken today into a blockchain environment, there is incredible time-saving potential for everyone involved.

The challenge in applying blockchain lies in the fact that it would disrupt the existing title insurance ecosystem and require getting historical title information stored on the chain.

“It’s a matter of understanding how that’s going to accommodate the regulatory environment of title insurance and how escrows are regulated. And the powers that be that control those industries will have a very big voice in what that looks like,” says Stuart.

Like many transformative technologies, the implementation and adoption of blockchain seems likely, but the timeline remains unknown.

6. How To Make Digital Transformation Work for Your Organization

While the real estate industry has experienced a fragmented digital adoption curve across its varied sectors, there is no doubt that consumer appetite for digital is on the rise. The pandemic resulted in new needs to transform the use of physical spaces, and the aftereffects continue to be felt. Digital transformation is something that starts with human needs and, particularly in real estate, must be guided by trusted human hands.

If your organization is ready to tackle digital transformation that better serves customers and improves efficiencies across the board, there are several critical next steps which we discuss in depth in this article:

1. Acknowledge that digital transformation is not a project

2. Secure C-level buy-in

3. Be prepared for change management

4. Measure the return on investment

5. Find the right partner(s)

CLOSING THOUGHTS

True transformation takes time, effort, and executive alignment. It’s critical to determine the needs of your customers and the associated digital priorities, then commit to a long-term strategic plan to achieve those goals. And in order for a successful digital agenda to come to life, real estate leaders will need to have not just a plan rooted in technology, but a plan for how to ensure agents and brokers adopt that technology. While the digital roadmap for real estate is far from complete, it is clear that the potential for digital transformation in the industry is far from untapped.

Curious how the recent NAR lawsuit may impact digital strategy in real estate? Read our article:

Leading With Transparency and Technology: How Forward-Thinking Real Estate Firms Will Innovate and Excel Post-NAR Lawsuit

Ready to make progress?

It’s time to lock in priorities, plans, and budgets for 2024. Let us know how we can help.